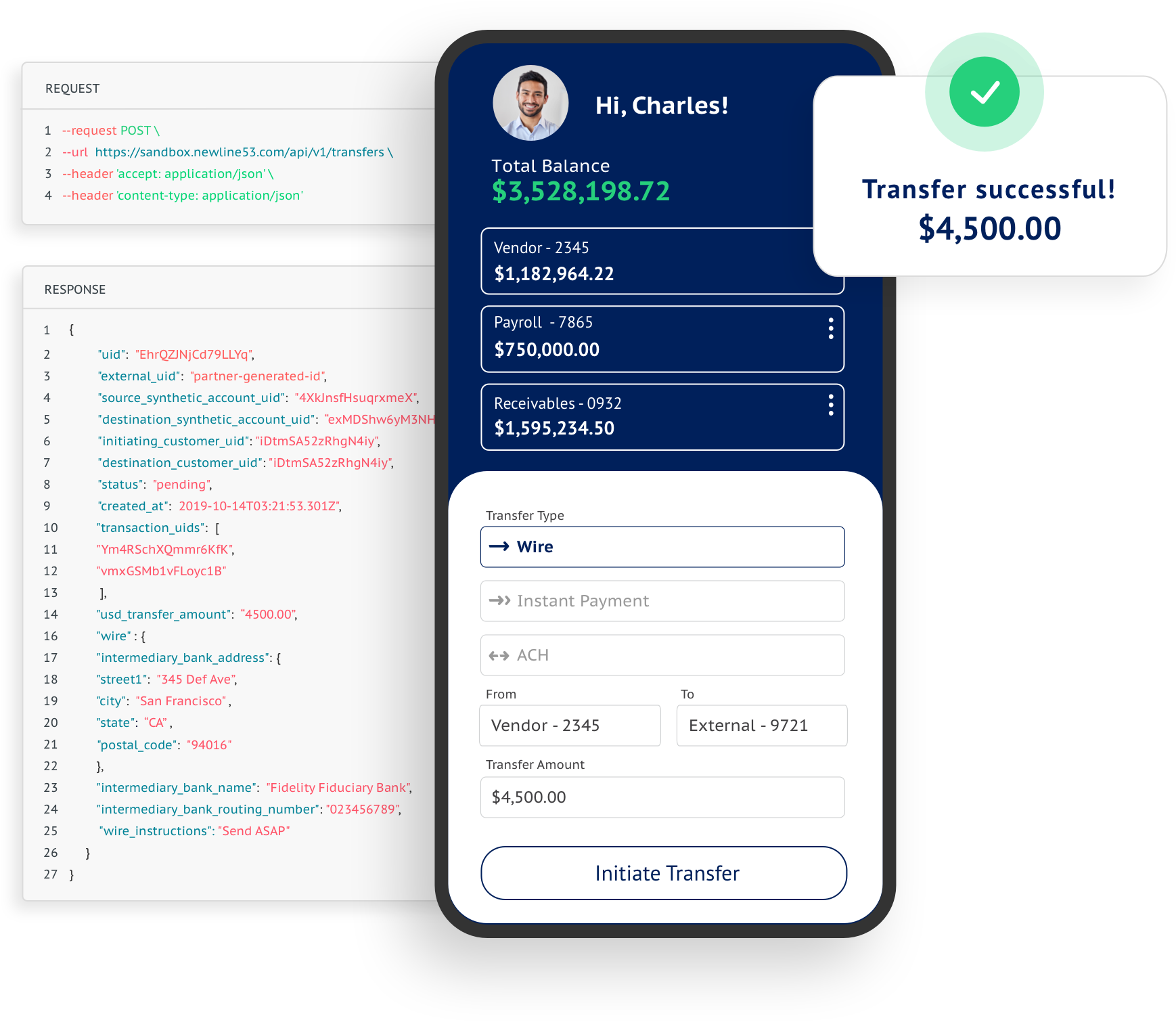

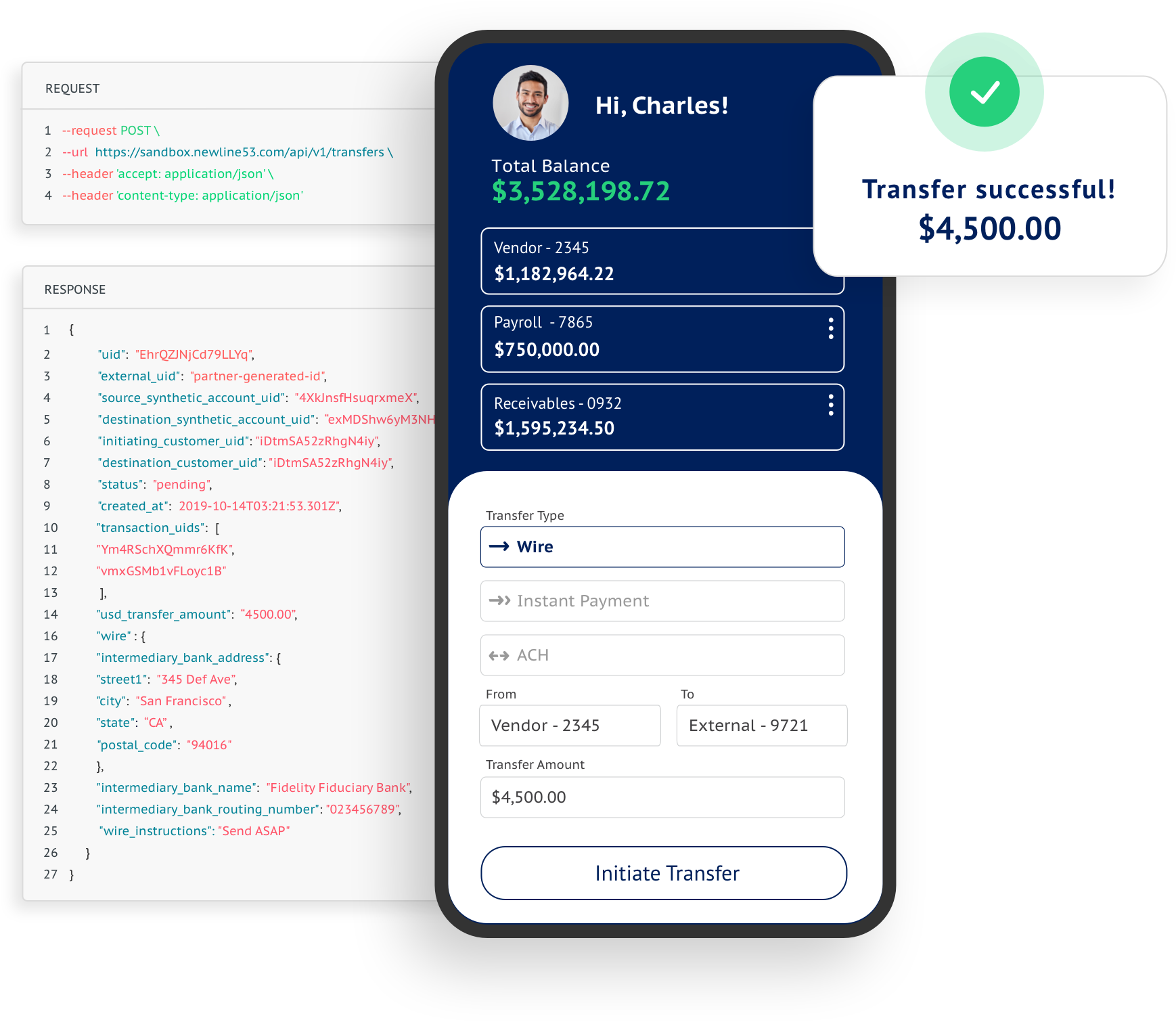

Payments and transfers

Initiate ACHs, wires, book transfers and Real-Time Payments with one API.

Backed by Fifth Third Bank, Newline™ by Fifth Third has the financial strength and stability to accommodate your growth at any scale. Set your product up for success and build responsibly with a reputable bank partner. With Newline, you get the best of both worlds: innovation and financial strength.

Everything you need to embed payments, cards and deposit solutions on a single platform. Newline invests heavily in platform innovation to ensure you have access to the latest in embedded finance technology today and in the future.

Initiate ACHs, wires, book transfers and Real-Time Payments with one API.

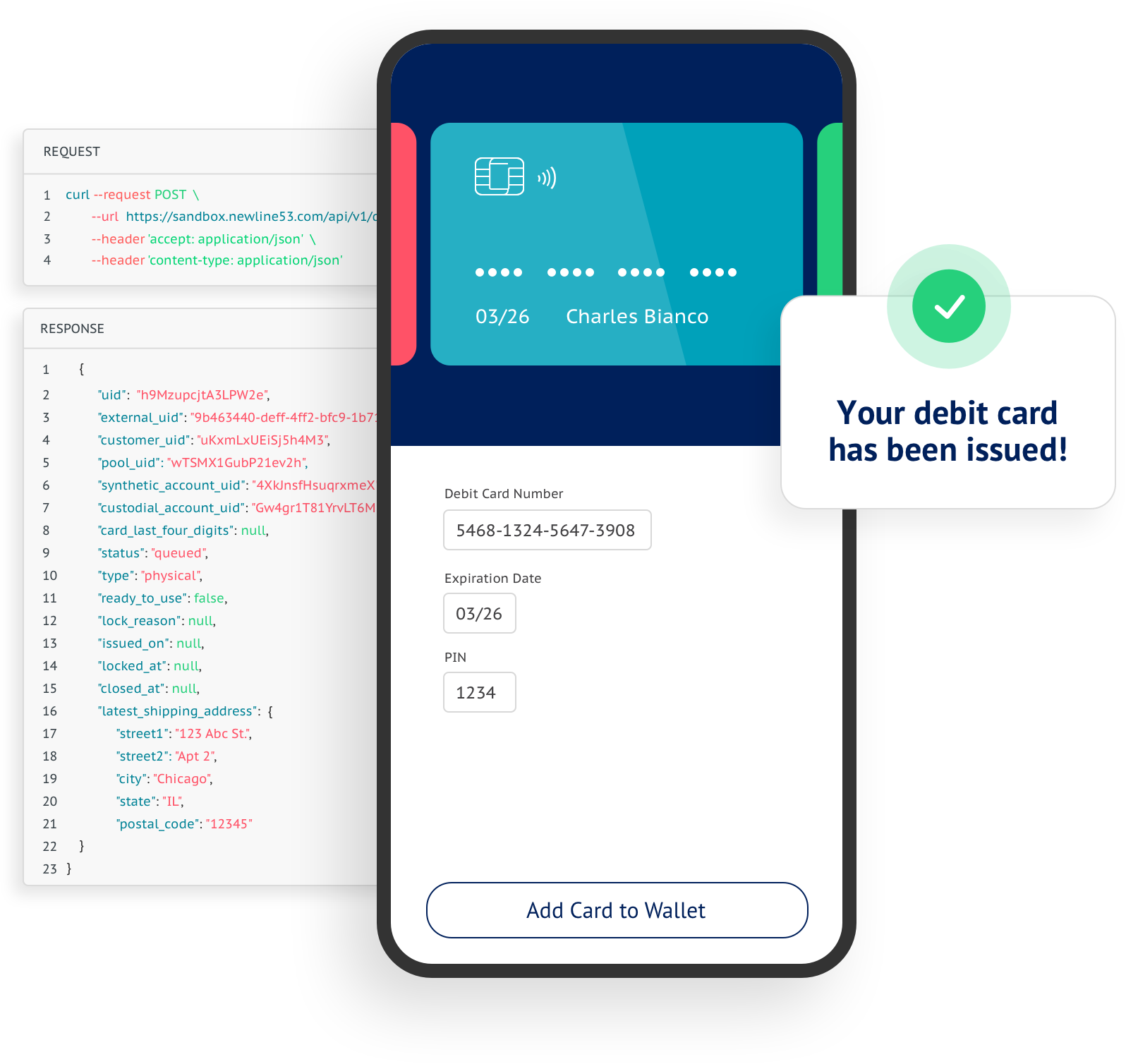

Issue commercial credit or prepaid debit cards in virtual and physical formats.

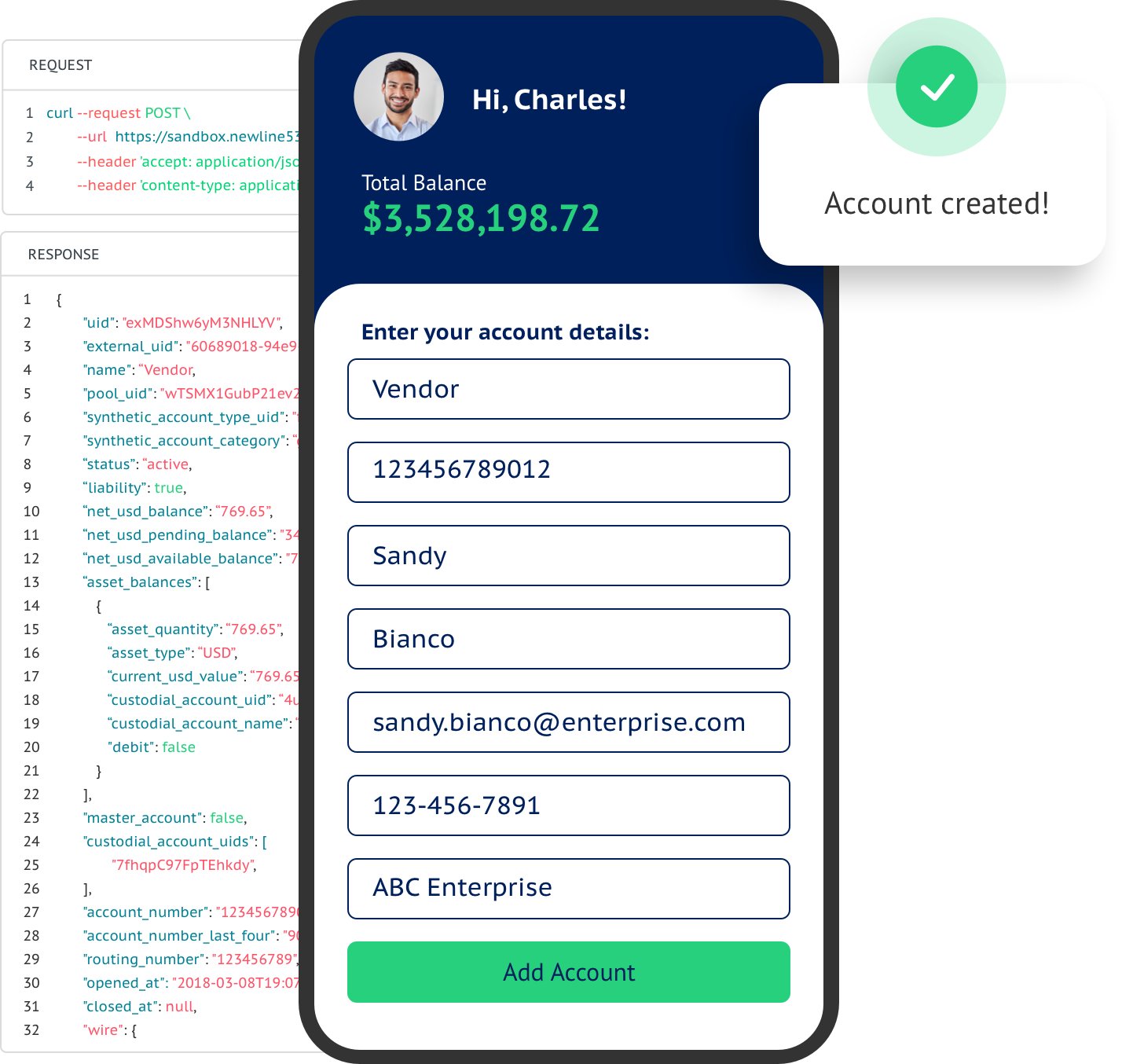

Maintain FDIC-insured bank accounts (when eligibility conditions apply).

Top 10 ACH originator1

$17.5 trillion+ processed

$213 billion+ total assets

From Fortune 100 firms to hyper-growth startups, Newline’s dedicated team is focused on delivering embedded payments and deposit solutions to support a range of clients and industries, including:

Enabling large-scale payment originators and merchant acquirers to move money on behalf of customers.

Partnering with industry disruptors to launch compliant alternatives to traditional banking.

Helping market leaders deliver frictionless employee experiences with programmatic payouts and pay cards.

Embedding payment capabilities into the applications of modern business management platforms.

Building, launching and scaling financial products is complex. We’ve been there, and we’re here to help conceptualize, deploy and support your embedded finance products from development to launch. Find out how our scale, technology and expertise can drive your business growth.

Credit products are subject to credit approval and mutually acceptable documentation. Deposit and credit products offered by Fifth Third Bank, National Association. Member FDIC.